VISION

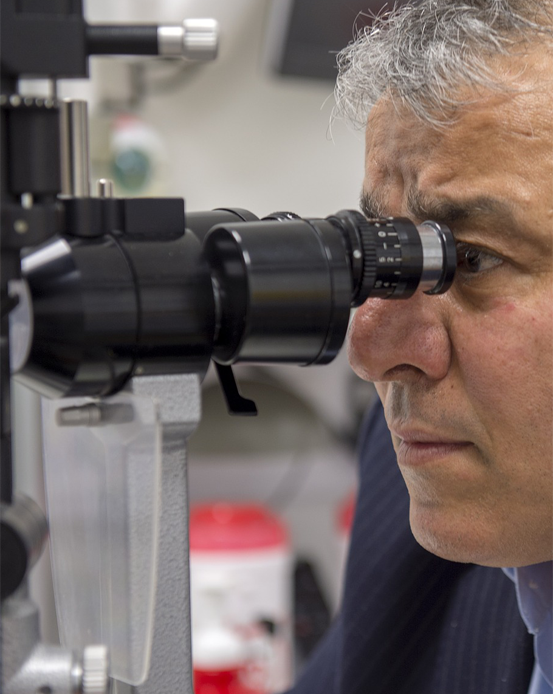

What is Vision Insurance?

Chances are pretty good you wear glasses or contacts—75% of Americans do, according to a survey by the Vision Council of America. Many health insurance policies do not help pay for them but not to worry that’s what vision insurance is for. Unlike health insurance, you can think of vision insurance a kind of discount plan. Beyond an annual checkup, you hope you never have to use your health insurance. Vision insurance, on the other hand, helps pay for purchases you know you’ll need to make every year or two — and want to make, since your glasses help keep you stylish! Vision insurance plans offer a set amount of money to put toward the cost of eye exams, glasses and contacts. Most eye care plans don’t have a deductible — meaning you can redeem their value immediately rather than having to pay out of pocket before they kick in

What Does Vision Insurance Cover?

Vision insurance generally covers eye exams, frames, lenses and contacts. Some plans will cover a certain dollar amount every year, and some every two years. The major vision insurance companies like VSP and Humana also have different arrangements with different retailers, meaning you may get more savings at select partner retailers depending on your plan.

What Doesn’t Vision Insurance Cover

Stop trying to bring transition lenses back — it’s not going to happen, and plus, your vision insurance company won’t cover it. Glasses seem pretty straightforward, but start throwing in the extra bells and whistles (trifocals, progressives, anti-glare, anti-scratch, anti-impact), and things add up fast. Your vision insurance will cover a certain dollar amount for your lenses and frames, but it may fall short if you have a laundry list of extras. Vision insurance also won’t cover the full cost of elective procedures like LASIK and PRK, though depending on the plan, you could get partial coverage

How Much Does Vision Insurance Cost?

Depending what carrier you choose to focus on, the ranges are from $65 – 250+ per year per individual.

Is Vision Insurance Worth It?

If you’re someone who wants to get new glasses every year or constantly replenishes contacts and you find a plan that has a benefit maximum significantly higher than the premium you pay, vision insurance will likely save you money and is worth the investment. If you just want to get a pair of reading glasses and keep them for five years, you’re probably better off just paying out of pocket.When vision Insurance Covers a Medical Emergency

Vision insurance isn’t legally required, like health insurance or car insurance, and it isn’t necessarily a critical part of your financial safety net, like life insurance. But like other insurance products, you should judge your coverage need based on your usage. A few things you’ll need to keep in mind when selecting your vision insurance:

The basics you need.

Eye exams, eyeglasses, and contacts are some of the staples of eyecare. But the discount or allowance you receive will depend on the plan you choose. You’ll also have to decide where you’ll get these items; as you’ll see, the frames and lenses may be separate costs at some retailers, and you’ll be able to get contacts at some retailers but not at others.Additional enhancements.

Glasses seem pretty straightforward, but when you get into progressive lenses, trifocals, transition lenses (that turn from cool guy sunglasses outdoors to bookworm standard glasses indoors), anti-glare lenses, impact-resistant lenses, metal frames, and more, you can see that there’s a lot out there. Bells and whistles will often cost more, and they may not always be covered by your plan.